Canadian Dollar Recovers Together with Oil

|

Getting your Trinity Audio player ready...

|

Canadian dollar

The Canadian dollar is facing heavy selling pressure as oil drops to levels not witnessed since 2003. As of today, oil is getting massive support from the cheap hunters and the US government.

The latter decided to obtain 30 million barrels of oil for the strategic reserve. The beauty part is that the exchange will not affect online casinos in Canada, rather real money gamblers can keep on placing their bets now!

However, on a more important note, Canada made a report that the New Housing Price Index has made an increase of 0.4% month-over-month and 0.6% year-over-year.

Whilst all these developments were taking place, analysts were voicing for the index to be slightly changed. Therefore, this development came as a very positive surprise, which went on and gave an indication of the strength of the housing market before the impact of coronavirus.

Today the US reported that the final claims made an increase of 281,000 comparing to the prospects of 220,000. This giving a clear indication that coronavirus issues are making a huge impact on real life.

However, there are expectations that the initial claims, that will be published next week, will be much worse.

At the same time, the coronavirus pandemic has also contributed to the plummeting of the Philadelphia Fed Manufacturing Index. The latter gave an indication of a negative reading of -12.7 compared to the consensus of +10.

Canadian Dollar Forecast

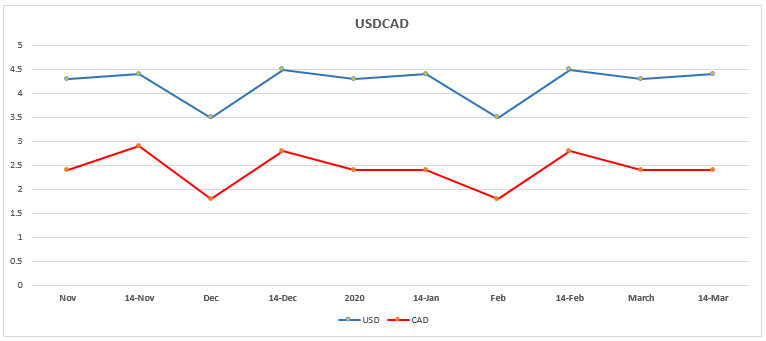

The USD/CAD increased higher this week. This is after many traders sought the absolute safety of the Greenback along with a devastating drop in crude oil look to devalue the Canadian economy. As a result, the duo quickly rose above the 1.45 level.

The Canadian Dollar Technical Analysis

The massive upside in the USD/CAD was halted at 1.466 close to the previous high of 1.4650. At this point, the range that is between 1.4650 and 1.4670 is the new fundamental level.

Still on that thought, the past move into this territory was made back at the beginning of the year 2016. This is when USD/CAD reached 1.4690. This simply means that the duo will need a very strong catalyst so that it moves past 1,4700. This is because at the end it might meet a very strong resistance that will be way above 1,4650.

Conclusion

On the support side, USD/CAD carries no material levels closely, simply because it’s running from 1.4000 to 1.4667 took quite a number of days. This means traders must have a close watch carefully despite the recent low of 1.4420 can come to a hold.

FAQs